estate tax changes over time

However the law did not make these changes permanent and the estate tax returned in 2011. The current 11700000 federal estate tax exemption amount would drop to 5 million adjusted for inflation as of.

The Estate Tax May Change Under Biden Affecting Far More People The New York Times

In 2022 it rises to 1206 million.

. In 2022 the federal estate tax ranges from rates of 18 to 40 and generally only applies to assets over 1206 million. 1 Any funds after that will be taxed as they pass. Estate Tax Rate Increase.

How did the tax reform law change gift and estate taxes. Changes in Estate Tax Over Time. The Patient Protection and Affordable Care Act added an additional 38 percent.

List of the estate and gift tax proposals gives the date each proposal was eventually enacted in some form. Taxation of appreciation at death or at the time of gifts carryover basis enacted. The American Taxpayer Relief Act of 2012 increased the highest income tax rate to 396 percent.

The new law also has important provisions that may affect current estate plans. Taxable Estates Over Time. The expected proposal would increase the top tax rate to 45.

The estate tax is imposed only on the part of the gross non-resident aliens estate that at the time of death is situated in the United States. The 2017 tax act Public Law 115-97 doubled the exemption amount for the estate tax through the end of 2025. Increased to 5 and separate taxes were introduced for estates and excess business profits.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. Several key changes and the impact on estate planning are summarized below.

A taxable estate of 6000000 would carry no estate tax even after the Sunset. So even if you. More importantly smaller taxable estates of over 3500000 may then be subject to estate tax.

2022 2021 Established 10-day period July 31 - August 9 2021 during which certain items were exempt from state and local sales taxes. Because the BEA is adjusted annually for inflation the 2018. Some states also have estate taxes.

The revenue portion of the Build Back Better Act BBB that is moving along dramatically changes the landscape for transfer taxes ie. However the law did not make these changes. These taxes were rolled back.

The number of people paying taxes in the US. The Modern Estate Tax Evolves. The current top tax rate on estate assets above the exclusion amount is 40.

The Estate Tax is a tax on your right to transfer property at your death. The Estate Tax is. Scheduled Changes to Estate and Gift Taxes.

As Chart 3 shows in 1916 only estates over 1 billion in todays wealth would have been taxed at the top rate of 10 percent. The tax reform law doubled the BEA for tax-years 2018 through 2025. Contrast that with the top rate of 55 percent on.

Sales Tax Back to School Sales Tax Holiday.

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Potential Tax Law Changes That May Impact Estate Planning

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

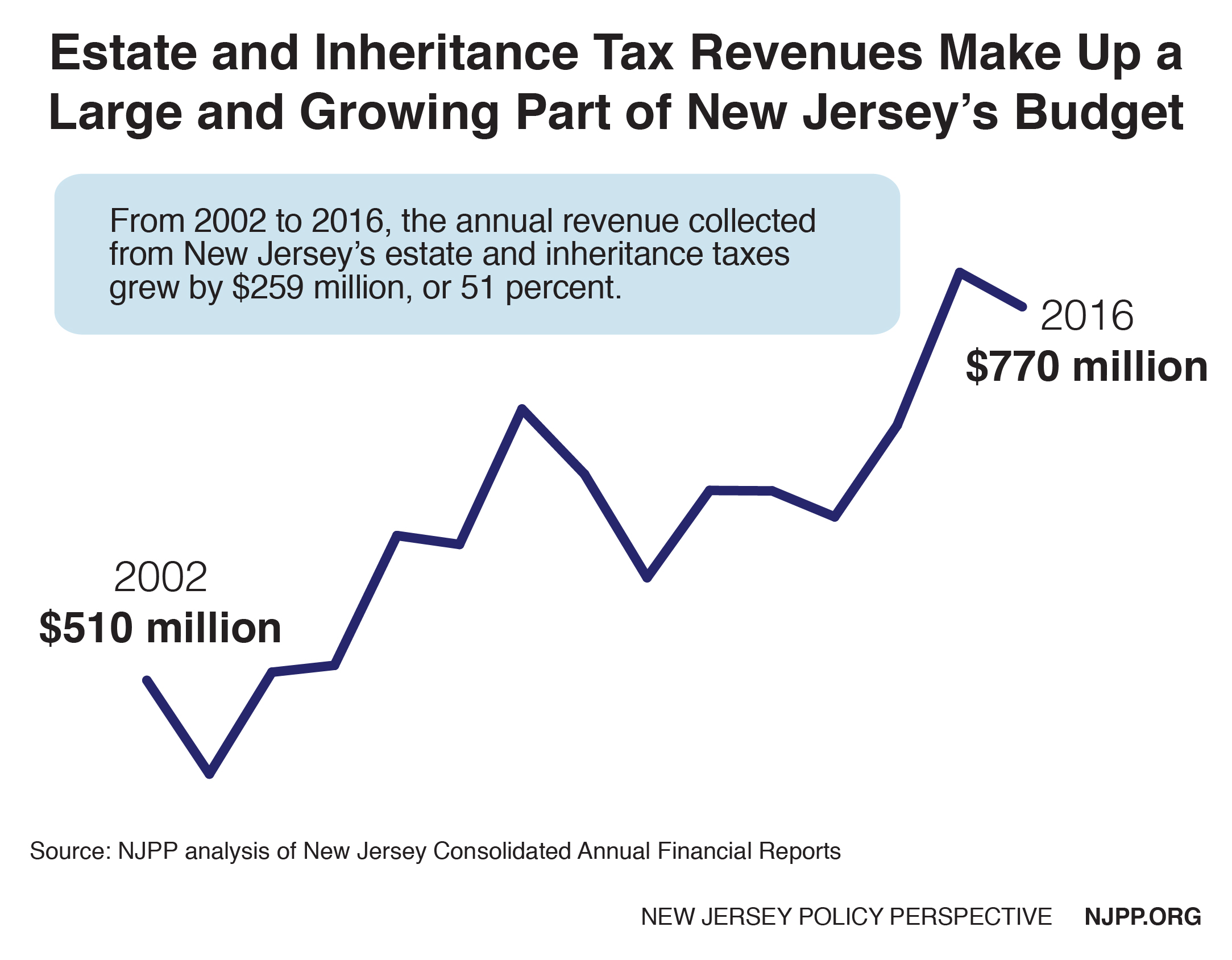

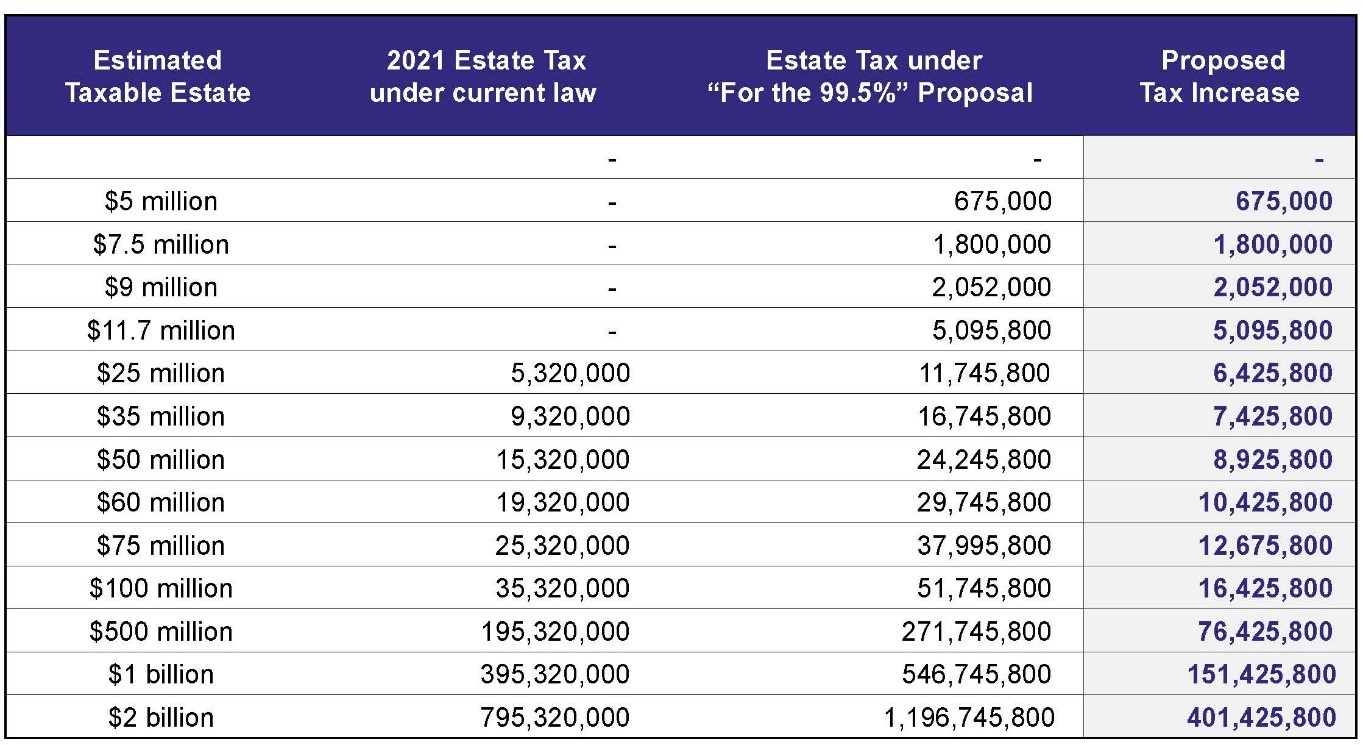

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Biden S Proposed Estate Tax Changes To Stepped Up Basis Rule Talley Co

Estate And Gift Tax Changes Stark Stark

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Plumbing Mechanical

2020 Estate Planning Update Helsell Fetterman

Estate Taxes Under Biden Administration May See Changes

Federal And Connecticut Estate Tax Law Changes That Could Affect Your Family S Estate Northeast Law Center

Senate Bills Propose Changes To Estate Tax Wealth Management

All The New Estate Planning Changes It S Time To Act Stibbs Co P C

Estate Tax Changes Under Recent Tax Acts Tyler Stone Group

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Planning Now For The Estate Tax Overhaul Sax Wealth Advisors Llc

A Guide To Estate Taxes Mass Gov

2022 Estate And Gift Tax Exclusions Will Rise Cincinnati Estate Planning