inheritance tax changes 2021 uk

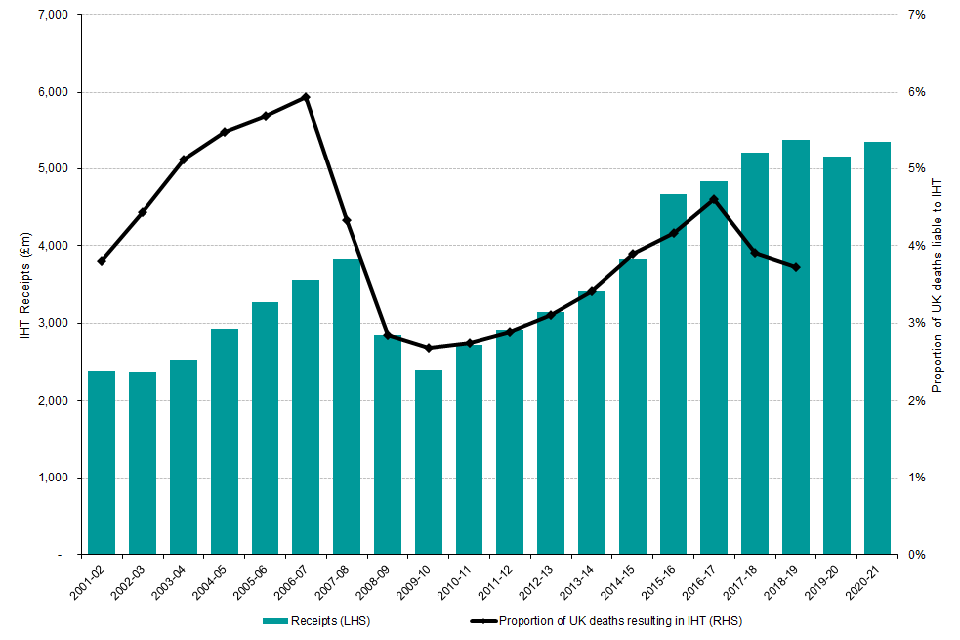

Inheritance tax IHT is levied on an estate when a person has died and is passing on assets so long as the estate in question is valued higher than 325000. In 5 years time until the end of the nil rate band freeze.

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax.

. Even a modest 4 increase in a couples estate valued at 1m could result in additional tax payable of 16000 after 1 year. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be. The Inheritance Tax charged will be 40 of 175000 500000 minus 325000.

The government has announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20252026. The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021. Reducing the IHT tax rate of 40 to a rate of 10 for estates up to 2m 20 for estates over 2m.

In accordance with the new changes if a person has died on or after 1 January this year only the value of their estate needs to be reported. 15 October 2021 1423. Inheritance Tax Changes - What You Need To Know.

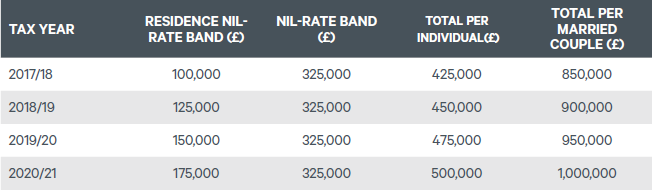

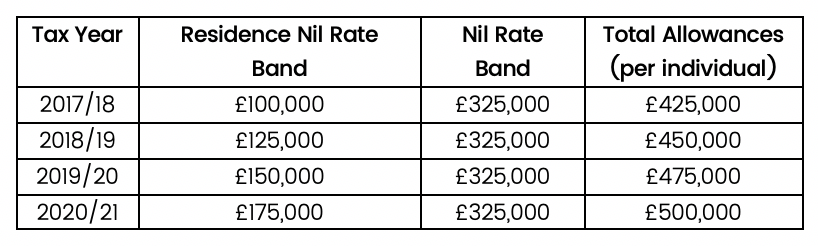

Assets needed to be sold to pay inheritance tax for higher rate taxpayer. The limit for chargeable trust property is increased from 150000 to 250000. In April 2017 the Government.

Inheritance tax IHT was a key talking point in the run up to Decembers general election. The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021. The rate remains at 40.

Estate tax applies at the federal level but very few people actually have to pay it. More than 200000 estates will no longer need to complete certain inheritance tax forms under the latest changes. In the current tax year 202223 no inheritance tax is due on the first 325000 of an estate with 40 normally being charged on any amount above that.

Understand how the tax-free nil-rate is calculated and when it can be transferred from one partner to another. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory Instrument. Assets needed to be sold to pay inheritance tax for basic rate taxpayer.

Currently estates that do not need to pay inheritance tax are. ICAEW technical editor Lindsey Wicks looks at the effects as more than 90 of non-taxpaying estates will no longer have to complete full inheritance tax accounts. Taxes are never popular but Inheritance Tax IHT is arguably subject to more criticism than any other.

The estate can pay Inheritance Tax at a reduced rate of 36 on some assets if you leave 10 or more of the net. Find out more. Corbyns Labour pledged to replace the current regime with a.

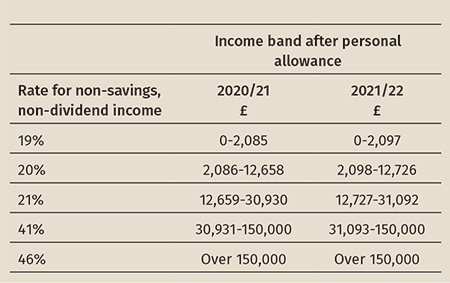

The government will introduce legislation u202fso that theu202finheritance tax nil-rate bands will remain at existing levels until April 2026. The Office of Tax. Tax rates and allowances.

Inheritance Tax changes. The Government has previously announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20212022. In addition the residence nil-rate.

There is normally no Inheritance Tax to pay if someone leaves everything above the 325000 threshold to their spouse or civil partner Image. Inheritance Tax Changes in 2022. Often referred to colloquially as death tax it is a levy.

There are currently two tax-free allowances for inheritance. A guide to when inheritance tax is payable and how to work out what IHT is due. Inheritance tax nil-rate bands maintained until 2026.

However what is charged will be less if. The Government is set to introduce legislation in Finance Bill 2021 so that the inheritance tax nil-rate bands will remain at existing. 05 March 2020 1145.

Annual allowance of 30000 which cannot be carried forward. For exempt estates the value limit in relation to the gross value of the estate is increased from 1 million to. Under the EU Succession Regulation the law of the place of residence on death is presumed to govern inheritance so if France is the deceaseds place of residence French law will apply to.

Will Inheritance Tax Change In 2021. Surrey is Britains inheritance tax capital where the average death tax bill adds up to 234000. Key points from Budget 2021.

Historic home county pays more inheritance tax than all of Scotland.

How Long Does Inheritance Tax Take Uk Ictsd Org

Will Uk Inheritance Tax Increase Because Of Covid 19 Stellar Am

Prepare For Potential Changes To Inheritance Tax

Inheritance Tax Planning May 2022 Uk Guide

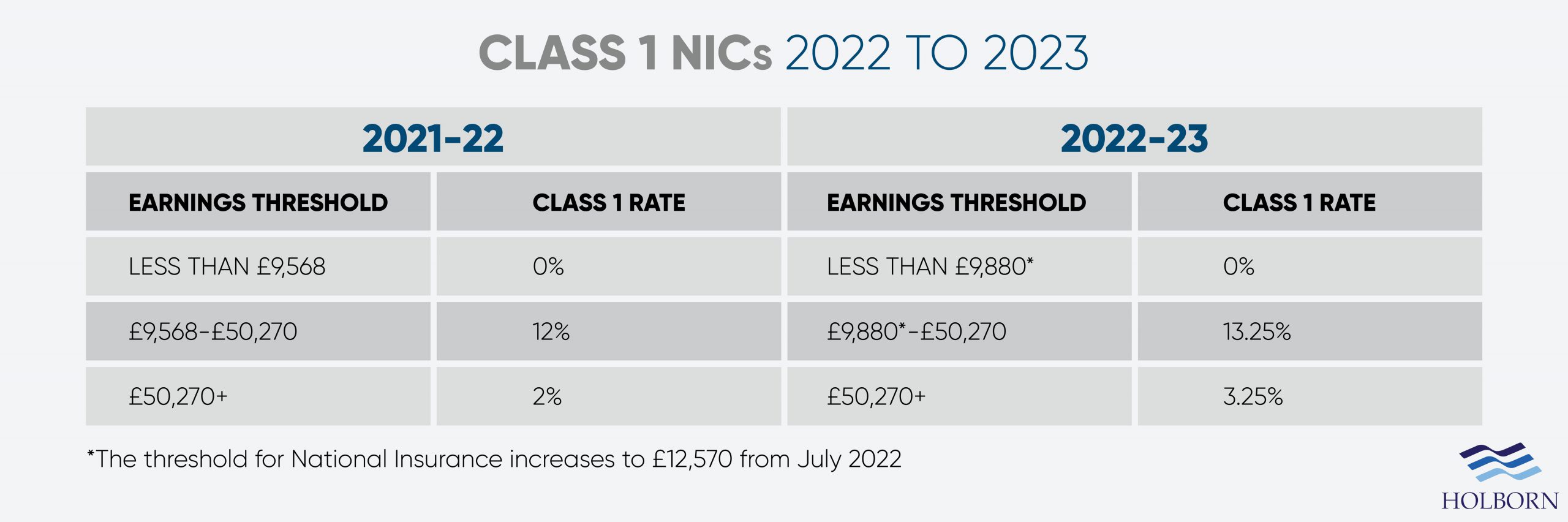

Changes To Uk Tax In 2022 Holborn Assets

Inheritance Tax Statistics Commentary Gov Uk

Inheritance Tax Guide For Property Investors Landlords

Inheritance Tax The Residence Nil Rate Band

Inheritance Tax Regimes A Comparison Public Sector Economics

January 2022 Inheritance Tax Changes All You Need To Know Key Business Consultants

Tolley S Inheritance Tax 2021 22 Lexisnexis Uk

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies Uhy Internationaluhy International

Clarke S Offshore Tax Planning 2021 22 28th Edition Lexisnexis Uk

How Much Inheritance Tax Will I Pay In 2022 And How Can I Reduce Or Avoid It

Pfp The Rise And Rise Of Inheritance Tax

Uk Tax Receipts 2000 2019 Statista

Are Uk Inheritances Taxed In France Harrison Brook

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph